The Poly community comprises just 0.00001% of the world’s 8.1 billion population. As climate change continues to wreak irrevocable damage, what can a single school possibly do to shift our planet’s trajectory? While not a panacea, one action would make environmental, financial and moral sense: Poly should reallocate its investment dollars away from the fossil fuel industry — which accounts for a staggering 75% of global greenhouse gas emissions globally — and toward companies leading the transition to net zero.

Poly would be far from the first organization to take this step. More than 1,600 institutional investors managing over $40 trillion in assets — from Princeton University to Allstate Corporation to Ben & Jerry’s — have already divested from companies with exposure to fossil fuels. Poly’s private K-12 school peers, such as Nueva School and Harker School in the Bay Area, are following suit.

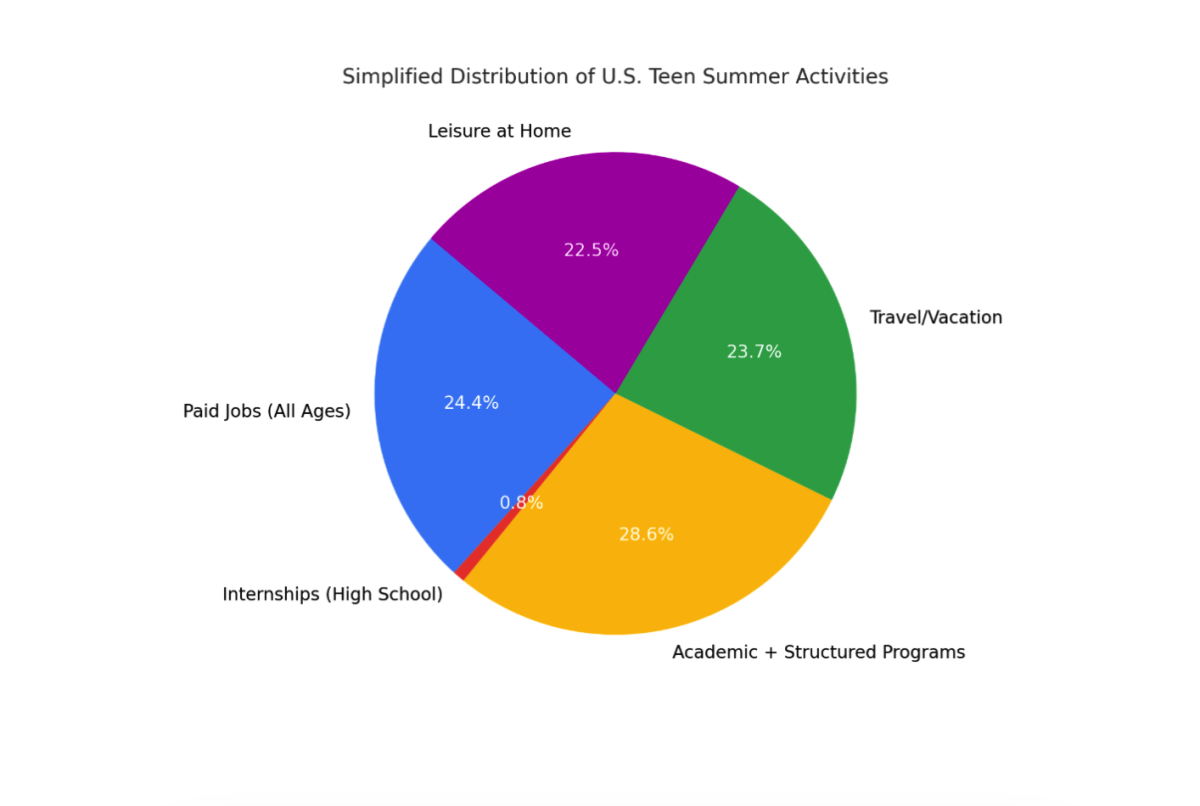

Does divestment diminish investment returns? A Paw Print analysis of global equity-market performance found that the MSCI All Country World Index (ACWI) that excluded fossil fuels outperformed the broader index over the past 10 years, generating 8.34% compared to 7.93% annual returns and experiencing lower volatility. Independent studies conducted by two leading investment firms, BlackRock and Meketa, corroborated those findings. “No investors found significant negative performance from divestment, but rather, have reported neutral to positive results,” stated a 2023 BlackRock report.

Divestment is not just the financially prudent choice — it’s also compelled by Poly’s credo, which states that “we strive to be responsible and contributing members of … our school community and the world.” Supporting fossil fuels defies that credo. Don’t we all — students and administrators alike — need to consider the global impact of our actions?

As Poly’s own environmental, social and governance (ESG) policy acknowledges, “Given that environmental, social and governance factors can meaningfully impact investment returns, the Committee believes that taking such factors into account as part of its investment process will help the Committee prudently manage the endowment for Poly’s long-term benefit.”

According to Kristin Ceva, Trustee and Chair of Poly’s Investment Committee, “Our ESG policy ensures that we are monitoring our investment managers and making sure that they incorporate a broad range of these factors into their investment process and decision-making.” Yet the intent underlying the ESG policy and the principles undergirding fiduciary duty necessitate more than mere monitoring. Without follow-through, policies are just words.

Critics of fossil fuel divestment claim that it won’t move the needle on emissions since fossil fuel shares sold by one institution will simply be purchased by another. But while Poly’s $102 million endowment is just a drop in the bucket of the $4 trillion fossil fuel industry, the aim of divestment is not necessarily to defund the entire fossil fuel industry. Rather, by divesting, Poly would spur other K-12 and secondary schools to do the same — thereby building a pervasive stigma against fossil fuels that could drive policymaking.

Others worry about disrupting longstanding investment portfolios. According to Keith Huyssoon, Chief Financial Officer, “It would be quite tricky to simply ask each of [our] 10 investment management firms… for Poly’s funds to only be invested in firms with no connection to fossil fuels.”

Tricky, yes — but far from impossible, as the growing list of divested schools confirms. And because the existential risk posed by climate change outweighs inconvenience, we cannot afford complacency.

The steps forward are straightforward: first, Poly should disinvest from public equities and fixed-income funds with exposure to fossil fuels, then reinvest in funds that provide comparable exposure to these asset classes while targeting issuers advancing the energy transition. For example, an S&P 500 Index Fund could be replaced by an exchange-traded fund benchmarked against the S&P 500 Net Zero 2050 Climate Transition ESG Index. In doing so, Poly would retain some exposure to traditional energy companies that have committed to decarbonization — companies that possess the monetary and intellectual capital needed to accelerate the development of green technologies.

Second, Poly should increase its investment in funds dedicated to clean energy. “If you’re thinking long-term, you’re thinking about how the world is changing — for example, the rise of renewables, the growing importance of diversification of our energy portfolio or battery storage,” said John Onderdonk, Chief Sustainability Officer at Caltech. “Our investment group is very focused on forward-thinking technologies and how they get into that, primarily because it’s a great investment.”

Poly cannot single-handedly salvage our planet by repositioning its investments, but it can spark and galvanize the fight amongst schools for decarbonization. And by living true to its stated values, Poly can inspire all of its students to be agents of change.

“If every institution and or individual does this, mitigating the effects of climate change becomes much easier on the whole,” said senior Evelyn Younger, co-leader of Closing the Loop Group, an Upper School sustainability club.