When should you invest in a Roth IRA? What’s the difference between Perkins and Stafford loans? What are the different types of 529 plans? When should you deposit money into a CD versus a regular savings account? You would know the answers to all these questions if Poly offered a financial literacy course. I’m lucky enough to have a mom who taught me that learning financial literacy at a young age is like learning how to read. It’s difficult at times yet essential.

When I was 10, I would perch eagerly in front of the bright glare of a computer, my small hand scrolling steadily through personal finance courses on websites like Khan Academy. Terms like stocks and bonds, capital gains, assets, liability and amortization tangled and knotted together, thin pieces of thread woven chaotically into a ball of yarn spinning in my head. I inadvertently unlatched the lid of Pandora’s Box, filled to the brim with all these confusing terms, detailed laws and intricate plans my Lower School-self faced with a blank stare. I couldn’t process anything on my own.

School teaches you how to make money but not how to take care of it. We attend Poly with the hopes of one day having successful careers, but we will leave Poly with the fear of one day wasting our hard-earned dollars. We lean eagerly over our desks at school, scribbling notes with cramped hands, taking tests with tired minds and absorbing lectures with attentive ears for at least seven hours each day, taking all these classes to learn all these skills that we need for the future, a future that is dependent on financial literacy.

Managing money is a task everyone has to do. Saving is a task everyone has to do. Paying taxes is a task everyone has to do. If you end up making millions of dollars in your life yet lack basic financial skills, you’re at risk of losing even more money, and if you don’t earn as much, you still have to learn how to manage what you do have in order to survive. Hunching over a desk in five years, staring at a hefty credit card bill they didn’t pay off, worrying about debt and realizing they have little money in savings, Poly students will feel their lack of financial literacy.

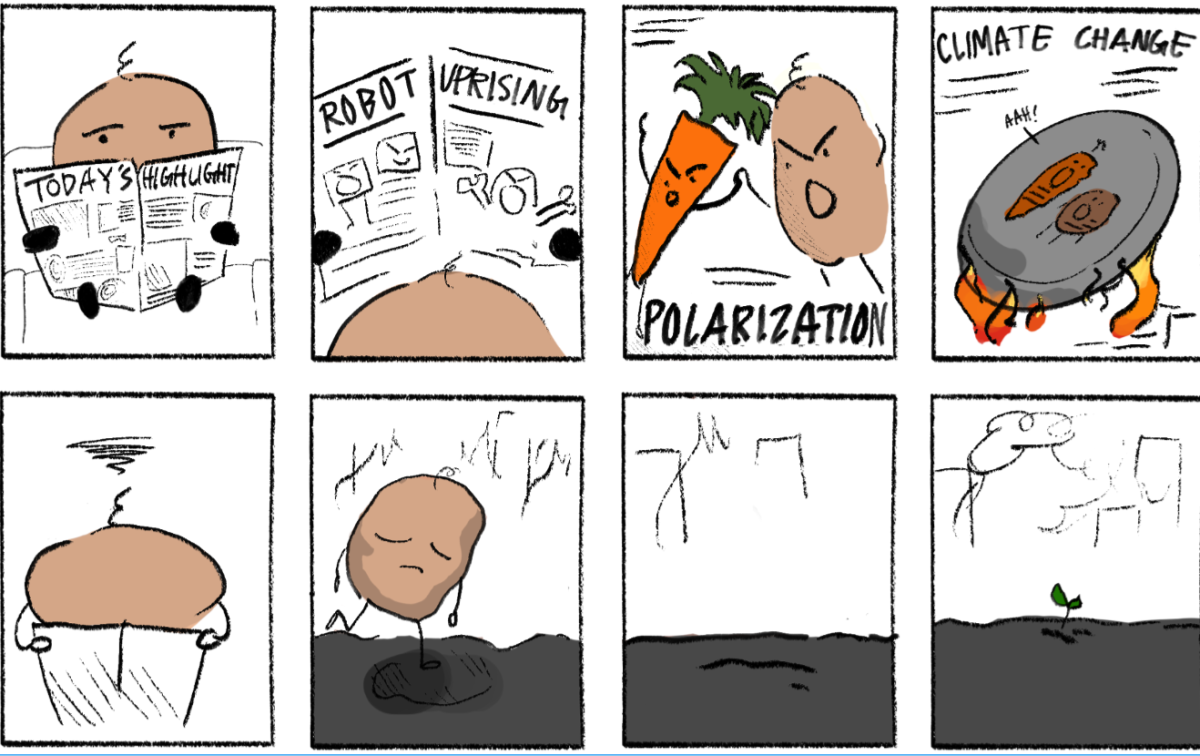

In 2022, financial illiteracy cost Americans more than 436 billion dollars, which means you could buy a Tesla for every single person in New York City and still have money left over. One of the largest transitions in terms of financial responsibility is college, which is just around the corner for all of us, which is what we have been preparing for all of high school, which is why it is vital we begin learning now. The average American has $30,000 of student loan debt, which tugs at your ankles and drags you down. And in college, you have to make so many more decisions about saving and spending money. When you step onto a college campus, credit card companies swarm around you like a pack of lions surrounding a helpless deer, persuading you with catchy phrases and benefits to sign up for their card.

We must invest in stocks and in the future of our students. Most Poly high school students don’t know how to do taxes or create a budget or obtain a loan or pay off a credit card, which are all basics of financial literacy. We are as prepared to handle money in the real world as a baby is equipped to recite Shakespeare. I’m a year away from graduating, and I, along with many of my peers, still don’t know anything about personal finance. We don’t need to become Wall Street, but we must learn at least the basics.

Finally, financial illiteracy, more common among lower-income Americans and people of color, is an issue of equity, and it contributes to the large wealth gap in our society. While Poly preaches diversity, equity and inclusion, the lack of a financial literacy class proves it does not practice these principles. The students who need financial education the most are left on the lowest steps as many students aren’t receiving finance lessons at home, and this practice is even less common among lower-income families. Currently, 15 states require a personal finance course in all public schools. We are behind other schools. We are behind on our DEI mission. We are behind on our duty as an institution to its students. Shouldn’t we live up to what we preach?

I recommend that Poly offer, similar to the Senior Seminar class, an elective second-semester senior year when students are leaving home, becoming adults and undertaking more responsibility. As a current junior, it’s imperative that if not this year, then next year, once a week, seniors should meet to learn how to manage loans, budget income, pay taxes, invest money, use a credit card, maintain a good credit score.

Despite the fact that past students have given this same speech, which has been happening for as long as my teachers can remember, and Human Development Department is willing to adapt its curriculum, nothing has changed. Poly must change. I spoke with Andy Yoong ‘23, who gave a similar speech, and he shared that he was unable to make any progress as he became busy during his senior year, yet why should one senior be responsible? They shouldn’t. Students shouldn’t teach Poly, Poly should teach its students. Please implement a personal finance course for the sake of us students.